State Rep. Lou Lang has proposed a brilliant and fair plan to help the state of Illinois dig itself out of its multi-billion dollar debt. Change the state’s fixed income tax rate for everyone and replace it with a scaled tax that actually reduces the state tax for most taxpayers, those earning under $200,000, and slightly raising it for everyone else. Lang says the plan could generate $1.9 billion a year in new and badly needed income

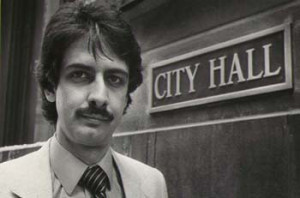

By Ray Hanania

Ray Hanania

I’ve always liked State Rep. Lou Lang, even though he doesn’t represent the Southwestland region.

Some people might think that’s strange because Lang is Jewish and I happen to be Palestinian. You don’t have to read the headlines coming from Israel and Palestine to know that most Jews and most Palestinians have a hard time getting along. But we do.

Lang is a Democrat who represents the 16th Illinois House, including Skokie. He has represented that district for more almost 30 years.

Some might say Lang has been in that office too long. But I say he is a public official who is good at his job because he hasn’t let his ego overcome his commonsense. Obviously, Lang hasn’t tried to be governor, congressman, senator or President of the United States.

He’d probably be good in each one of those offices. But instead, he has stayed in the House representing his district and also representing the best interests of the people of Illinois.

Which is why I am not surprised Lang proposed raising funds to off-set the state’s mounting debt by changing our state income tax formula.

Currently, everyone in Illinois pays a flat rate 3.75 percent of their income to the state. It’s not a bad rate at all. Seven states don’t have a state income tax. (Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.) Two (New Hampshire and Tennessee) require taxes on dividends.

State Rep. Lou Lang

A flat rate means you pay 3.75 percent of your income to the state whether you make $50,000 a year or $5 million a year.

I think that’s stupid. So does Lou Lang.

Of the 41 states that require state taxes, Illinois has the 3rd lowest tax next only to Indiana (3.3 percent) and North Dakota (2.9 percent).

Lang proposes we join the rest of the country and eliminate the flat tax. Under Lang’s proposal, taxpayers (married and filing jointly) would pay 3.5 percent for income of $200,000 or less; 3.75 percent on income between $200,000 and $750,000; 8.75 percent on income between $750,000 and $1.5 million; and 9.75 percent on income over $1.5 million.

For all others, the rate would be 3.5 percent on income of up to $100,000; 3.75 percent on income $100,000 to $500,000; 8.75 percent on income $500,000 to $1 million; and 9.75 percent on income above $1 million.

If we implemented Lang’s plan, the state would generate an additional $1.9 billion each year to help off-set the $10 billion deficit the state is accumulating.

Yes, Illinois is in a financial crisis. Although partisan politicians place the blame on each other, you really can’t blame any specific political party or politician. It’s been a mess for at least seven decades.

The real problem is our pension system, outrageous payments government promised to its workers we can’t afford. Some double dip and claim multiple pensions.

We definitely need pension reform. But we also need Lang’s reasoned proposal.

The majority of Illinois workers making under $200,000 a year would get a slight tax cut. And still, the state would make $1.9 billion more each year.

What’s there to think about?

Lang’s idea is certainly better than anything we have heard from Governor Bruce Rauner, who ignores everyday people like me and you. Rauner listens to the business lobbyists and the state’s wealthiest 5 percent, doing everything to protect their riches. Of course!

I say, make Lou Lang the governor. He’s the only reasonable person who has offered a reasonable solution to the state’s financial problems.

And I know he would take care of Illinois’ seniors, who desperately need financial help.

(Ray Hanania is a former Chicago City Hall reporter and political columnist. Email him at [email protected]. This column was originally published in the Southwest News newspaper group including the Regional News, Palos Reporter, Des Plaines Valley News and Southwest News-Herald Newspaper.)

RayHananiaINN

Hanania covered Chicago political beats including Chicago City Hall while at the Daily Southtown Newspapers (1976-1985) and later for the Chicago Sun-Times (1985-1992). He published The Villager Community Newspapers covering 12 Southwest suburban regions (1993-1997). Hanania also hosted live political news radio talkshows on WLS AM (1980 - 1991), and also on WBBM FM, WLUP FM, WSBC AM in Chicago, and WNZK AM in Detroit.

The recipient of four (4) Chicago Headline Club “Peter Lisagor Awards” for Column writing. In November 2006, Hanania was named “Best Ethnic American Columnist” by the New American Media;In 2009, he received the prestigious Sigma Delta Chi Award for Writing from the Society of Professional Journalists. Hananiaalso received two (2) Chicago Stick-o-Type awards from the Chicago Newspaper Guild, and in 1990 was nominated by the Chicago Sun-Times for a Pulitzer Prize for his four-part series on the Palestinian Intifada.

Latest posts by RayHananiaINN (see all)

- Graduated state income tax for Illinois makes sense - April 28, 2016

- Suspect charged in double homicide in Lyons, Illinois - April 26, 2016

- Cicero readies for Cinco de Mayo weekend celebrations - April 21, 2016